It’s election time! Who should you be voting for, and why or why not?

Well, if you’re concerned about how much money Gilbert is taking out of your pocket then here’s some information that should be of interest to you.

Increased Spending

Let’s take a look at a number that is simple to understand and see how spending has increased.

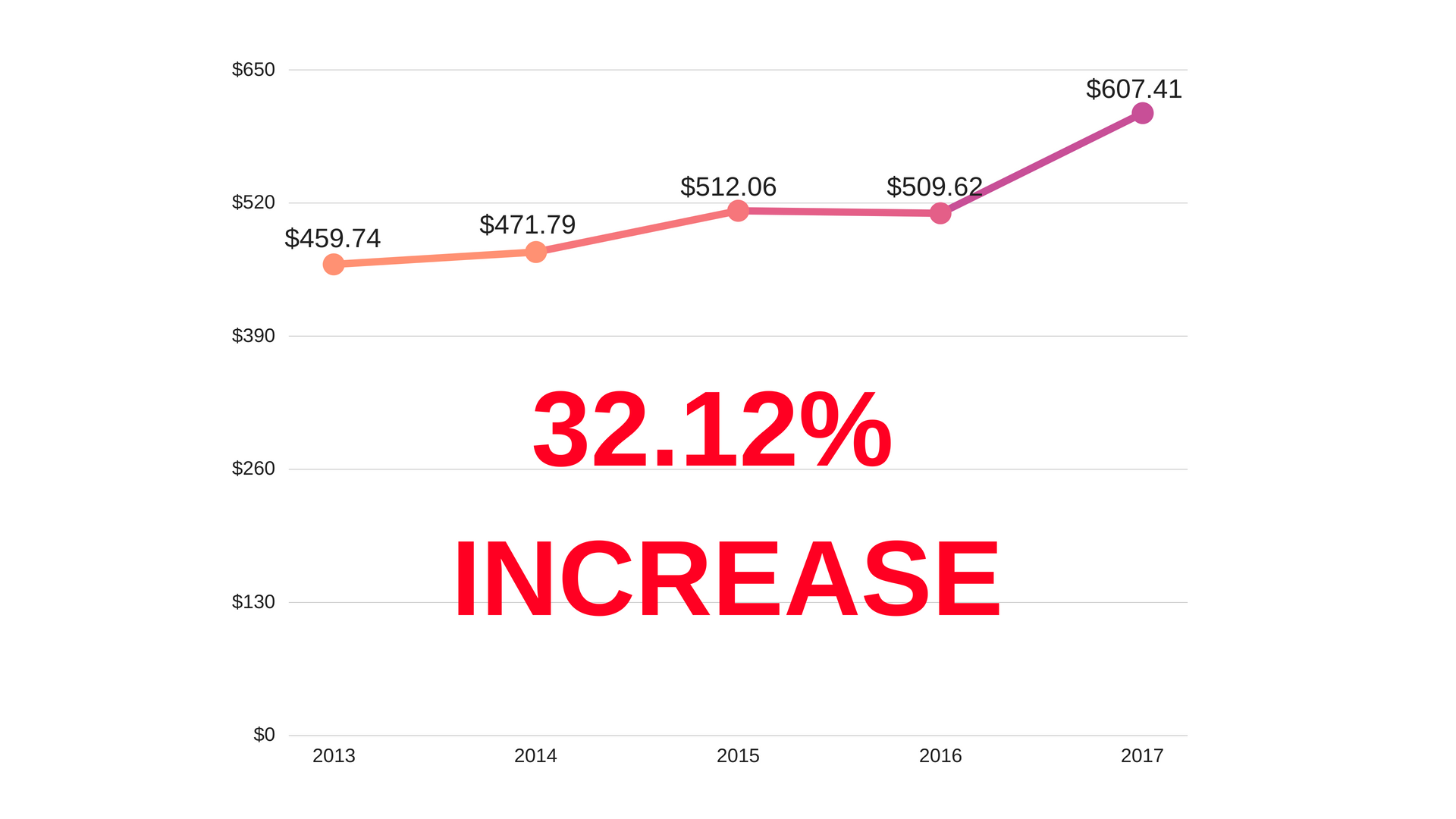

The following chart shows the increase in spending based on a per citizen dollar amount.

In 2013 the amount of spending per citizen was $459.74. In 2017 that amount grew to $607.42 per citizen.

That’s a HUGE increase of 32.12% per citizen in Gilbert.

The above 32.12% increase does not include large one time expenses like capital projects. If you're wondering about how they're spending on capital projects take a look at the next section under "Increased Taxes".

References:

2013 https://www.gilbertaz.gov/home/showdocument?id=2854 Page 22 Total Expenditures minus Capital outlay.

2014 https://www.gilbertaz.gov/home/showdocument?id=7892 Page 22 Total Expenditures minus Capital outlay.

2015 https://www.gilbertaz.gov/home/showdocument?id=13396 Page 22 Total Expenditure minus Capital outlay.

2016 https://www.gilbertaz.gov/home/showdocument?id=20740 Page 22 Total expenditures minus Capital outlay.

2017 https://www.gilbertaz.gov/home/showdocument?id=26242 Page 32 Total Expenditures minus Capital Outlay. All population numbers taken from page 145 of 2017 report.

Increased Taxes

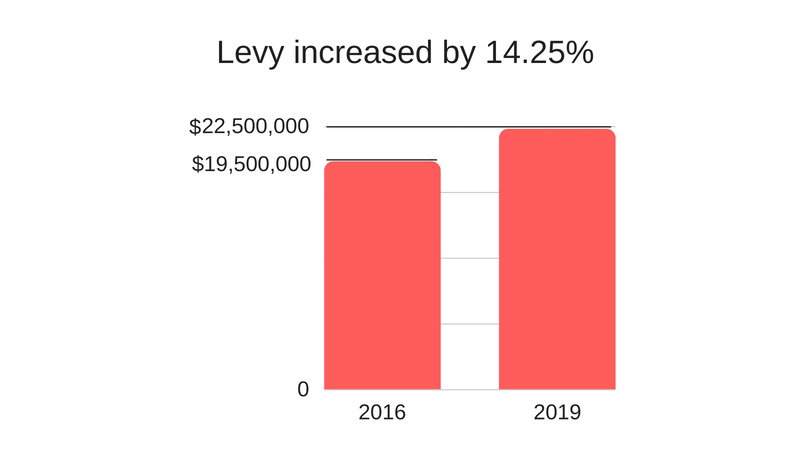

You’re paying more in taxes from 2016 through 2019 because the actual dollar amount of the levy has gone up during that time. The amount of the levy has gone up due to increased spending and higher debt.

Year Levy amount

2016 $19,500.000

2019 $22,280,000

Total Increase 2016 thru 2019 = 14.25%

How the levy gets determined.

1.County Assessor determines the value of all taxable property in Gilbert and sends report to town.

2.The town sets the levy (or total amount to be collected through the secondary property tax) and sends that amount to the assessor.

3.County assessor adjusts the rate to accommodate the total levy set by the town.

4.Town spending determines debt, which then determines levy amount which then determines levy rate.

So, even though these town council members will tell you they aren’t responsible for raising the levy, they in fact are because they spend, spend, and spend.

Who is responsible for higher taxes?

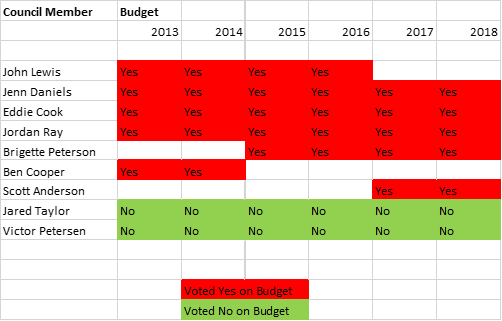

Here are the voting records for the town budget. We’ve listed examples of some of the votes related to large amounts of spending.

Total Budget

As you can see, the incumbents currently running for another term on the Gilbert Town Council have been responsible for increasing taxes over the last few years.

References:

2013 Item 52 https://www.gilbertdocs.com/pasearch/PublicAccessProvider.ashx?action=ViewDocument&overlay=Print&overrideFormat=PDF

2014 Item 49 https://www.gilbertdocs.com/pasearch/PublicAccessProvider.ashx?action=ViewDocument&overlay=Print&overrideFormat=PDF

2015 Item 41 https://www.gilbertdocs.com/pasearch/PublicAccessProvider.ashx?action=ViewDocument&overlay=Print&overrideFormat=PDF

2016 Item 28 https://www.gilbertdocs.com/pasearch/PublicAccessProvider.ashx?action=ViewDocument&overlay=Print&overrideFormat=PDF

2017 Item 29 https://www.gilbertdocs.com/pa3/PublicAccessProvider.ashx?action=ViewDocument&overlay=Print&overrideFormat=PDF

2018 Item 31 https://www.gilbertdocs.com/GilbertAgendaOnline/Meetings/ViewMeeting?id=395&doctype=2

The incumbents have proven they are willing to raise taxes and approve huge spending budgets that take money out of our pockets and away from our families.